Riding into a Secure Financial Future

Riding into a Secure Financial Future

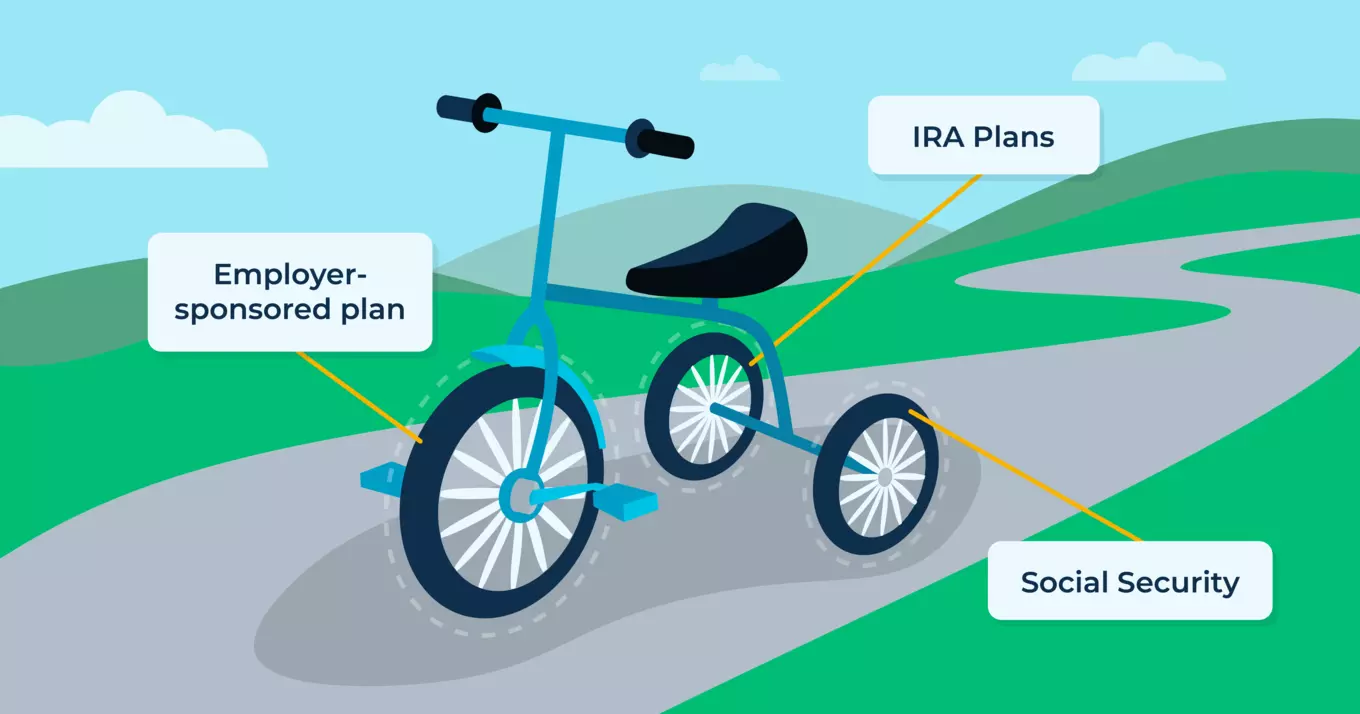

Picture retirement planning as a tricycle, a stable and steady vehicle with three essential wheels cruising you into your golden years. Just as a tricycle's three wheels work together to ensure a smooth journey, these three pillars of retirement planning— employer-sponsored plans, individual retirement accounts (IRA), and Social Security—work together to create a secure financial future.

The Front Wheel: Employer-sponsored plans help you steer toward a comfortable retirement, just like the front wheel sets the direction for a tricycle. The most common type of workplace retirement option is known as a defined contribution plan, including 401(k)s, 403(b)s, and 457s. These plans allow you to set aside and invest a percentage of your wages each paycheck—up to IRS annual dollar amount limits—to grow your retirement savings over time.

Additionally, they often come with employer-matching contributions, giving you an extra push toward retirement and, theoretically, a 100% return on that match. For example, if your employer matches 4% of your salary, and you make $75,000 annually, that’s a free $3,000 each year! Many employers offer 401(k)s as part of their benefits package, making it easy for you to get started on your financial journey.

The Back Wheels: IRAs and Social Security

Now, let's turn our attention to the two “back wheels”: IRAs and Social Security. These accounts play an essential role in financial planning, helping you maintain stability and enjoy a nice ride through retirement.

1. IRAs: There are two main types of IRA plans, both of which offer tax advantages and let you to save for retirement outside of the workplace. Traditional IRAs offer tax-deferred growth, allowing your contributions and investment returns to grow untouched by taxes until withdrawal. Roth IRAs, on the other hand, let you invest money after it’s been taxed, allowing contributions and investment returns grow tax-free to create a tax-efficient income source in retirement.

2. Social Security: The other back wheel is Social Security—a government-run retirement system that is financed primarily through payroll taxes. It provides a consistent source of income in retirement, ensuring that you have a reliable foundation to support you in your later years.

Riding into the Sunset

With a well-balanced approach, these components can help you confidently reach your retirement goals. So, ride off into the sunset knowing that you’ve got three wheels providing stable savings—and you’re well prepared for the road ahead.

Secure Financial Future is committed to safeguarding the decades-old integrity and professional management of investment funds. Through education and advocacy, Secure Financial Future can help every long-term investor take an active role in understanding and choosing the financial products they use every day to save for the future.